Guest Columnist – Alan R. Graas, Chief Economist, Sierra Asset Management

Over the past few years we have expressed increasing concern over the soaring national debt. As we look to the end of this decade, we view the growing national debt as our single largest economic concern. We hope the following question and answer format will help you better understand the debt problem and its long-term effect on our economy.1. Just what is our national debt? United States debt is the money borrowed by our government through the issue of securities by the Treasury and other government agencies. This debt is owed to the public, including individuals, businesses, and foreign, state and local governments, as well as the Federal Reserve System. It also includes money borrowed from other U.S. government agencies (e.g. the Social Security Trust Fund). 31% of our debt is owed to foreign governments.

2. How large is this debt? Currently, our total debt is approaching $17,000,000,000,000. That’s $17 trillion, the largest debt in the world. This is up from $9 trillion when we issued our first report in 2008. This does not include the projected Social Security and other social services unfunded liabilities of approximately $45 trillion. (For the purposes of this report, we will ignore this unfunded liability, as a reduction of benefits and/or an increase in taxes could eliminate this problem.)

Our national debt is increasing by over $4 billion per day, $1.5 trillion per year! The interest on this debt is about $450 billion per year, or 12% of our annual expenditures, and rising rapidly. Current record low interest rates are unlikely to continue. Rising interest rates will accelerate the rise in our debt.

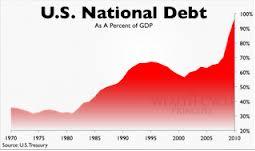

3. What is the national debt level? The debt level, including unfunded liabilities, is the debt as a percentage of the total production of the country (known as GDP). The current debt-to-GDP ratio is over 100%, up from 51% in 1988.

4. Isn’t our debt just money we owe ourselves, so we shouldn’t worry about it? No! No! No! This is perhaps the greatest myth currently in circulation about our national debt. The debt is real money owed to real people, companies, and governments (domestic and foreign). To default on this debt is unthinkable, as it would immediately send the world economies into the greatest depression the world has ever seen.

5. So what are we, as a nation, doing about it? So far, we are creating even more debt in the form of securities (mostly notes, bills and bonds) and selling this debt on the open market… in essence, “printing” (actually it’s done electronically) even more money. Quantitative Easing (we’re now in round 3) is another complex method of indirectly increasing debt by creating money to buy our own securities. Is this a Ponzi scheme? No, a Ponzi scheme is illegal… QE3 is apparently legal. So far, Democrats and Republicans have not been able to make any meaningful progress on reducing government spending and/or increasing government revenues, so the debt increases by over $4 billion every 24 hours.

6. So what will happen? Perhaps as early as the end of this decade, foreign governments (as well as our own citizens) will lose confidence in the U.S. dollar, as they realize that the U.S. cannot continue to print an endless supply of money to fund unbridled government spending. Obviously, the interest payments on our debt will exceed our income, so even more money will be printed. Foreigners will stop buying our bonds as the value of our currency plunges, and our bonds become worth less and less. We already received one major downgrade in our ability to make payments on our debt, and more downgrades can be expected.

We have already seen a massive decline in the dollar against most major first-world currencies. For example, in spite of the huge problems in the Europe, the U.S. dollar is down over 35% against the Euro and the British pound in the last 15 years (‘Been to Europe, Canada, Australia, or the UK recently?).

The dollar will continue to devalue against foreign currencies, eventually driving inflation through the roof. At some point, the U.S. dollar will lose its status as “the world reserve currency” and we will enter a terrible period of stagflation… A stagnant economy with out-of-control inflation. U.S. citizens will face this dreadful situation if we don’t corral government spending. Even massive tax increases would not be enough to stop the accelerating increase in our national debt at this point.

7. So, is there a solution? Yes! Yes! Yes! We are very, very fortunate that we could end deficit spending and spur massive economic growth in 24 to 36 months. How??? Consider these two solutions:

A. The U.S. spends over $2 billion per day in Iraq, Afghanistan, Pakistan, the Korean Peninsula, and Japan. The decade-long wars in the Middle East have crippled our economy; the Korean War has been going on for six decades, with at least 30,000 troops and civilian contractors on the ground in South Korea at all times; and, Japan pays only 30% of the cost of our huge military presence there. The total cost of these services has taken a terrible toll on the U.S. economy.

B. Excluding Social Security, the U.S. spends more than $2 billion per day on by far, the most massive social services system (per capita) in the world. While accurate figures are difficult to come by, the U.S. Department of Commerce reports that in most states the average person collecting welfare receives the full-time work equivalent of more than $10 per hour (California is at $11.59 per hour; Hawaii at $17.50). Why work???

A perusal of welfare fraud in our top 100 cities reveals a loss of at least $20 billion per year. About 50% of our citizens are collecting some form of welfare… many for decades. While we certainly cannot eliminate social services spending, cutting $2 billion per day in wasteful welfare programs and fraud would help avoid the collapse of the U.S. economy.

A significant reduction of the expenses in these two areas of the budget would require a transition period. Temporary domestic projects and work incentive and training programs will be required, but over a matter of a few years would yield massive benefits to the U.S. economy, including a huge gain in the employment rate.

8. If we are unable to stop the increase in our national debt, what is your strategy to avoid the catastrophic economic consequences o

f our unbridled spending? We’re glad you asked! We have already developed and put in place an “exit strategy.” That is, we will have no choice but to avoid U.S. dollar denominated investments. If you were to drill down through your current portfolio holdings, you would notice that we already have significant foreign holdings and investments in large, multi-national U.S. companies whose earnings are primarily non-US based. IF (and that’s a BIG IF) we continue down the present course, we will continue to diversify outside the U.S. to protect our clients from the ravages of run-away inflation.

9. Finally, what is the time frame for your forecast… How much time do we have? First, no one rings a bell as a signal to the world that we are hopelessly mired in debt. And, the financial melt-down will not occur overnight. It will most likely occur over many years, much like the devaluation of the dollar. The timing will also depend on what other alternatives are available. The Chinese Renminbi (Yuan) might become the new “world reserve currency”, but that won’t happen as long as China is still a communist government. Given the current conditions in Europe, and in the developing nations in Asia and South America, we are unlikely to experience the devastating conditions in our forecast for at least several years… still time to reverse our collision course with economic reality.

In summary, the national debt problem is growing at an alarming rate. We have already taken steps to protect our client investments against the ravages of unbridled inflation. However, we must emphasize that the dire consequences we are predicting are probably at least several years away and will not happen quickly. We will continue to monitor this situation very carefully and we will keep you informed of further developments.