MADERA COUNTY — As residents consider their vote on Measure L, the proposed Public Safety Tax scheduled for the Mar. 7 special election, many are questioning the information they’re getting and want answers from the County clarifying details of the measure.

We contacted the County to get their response to questions we’ve received from the public, and to assertions put forward by those in opposition to the measure.

The most common concerns are listed below in bold, followed by answers compiled from conversations with County Budget Director Joel Bugay, Chief Administrative Officer Eric Fleming, Madera County Fire Administrative Battalion Chief Matt Watson, and District 5 Supervisor Tom Wheeler —

The Madera County budget for the 2016-2017 Fiscal Year is $266 Million Dollars. Only $6.3 Million is spent for Fire Protection and Emergency Services (2.36% of the County Budget).

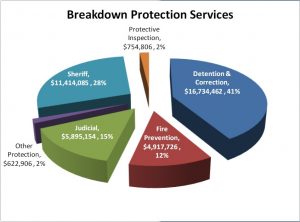

The County actually spends 64 percent of its discretionary budget on protection services. The Board of Supervisors (BOS) has discretion over just $63 million of the $266 million budget. The bulk of the expenditure is dictated by the State and Federal governments, and cannot be diverted by the Board of Supervisors to be spent in any other way.

The County actually spends 64 percent of its discretionary budget on protection services. The Board of Supervisors (BOS) has discretion over just $63 million of the $266 million budget. The bulk of the expenditure is dictated by the State and Federal governments, and cannot be diverted by the Board of Supervisors to be spent in any other way.

About $40 million (64 percent) of the $63 million is spent for protection services – Fire, Sheriff, Department of Corrections (Jail), Probation and Judicial Services (DA and Public Defender). This leaves the County $23 million to fund other essential public services and functions such as property assessments, auditor-controller, elections, tax collection, public works, facilities management, library services, veterans services, public guardian and other support services necessary for the operations of the county, including county counsel, insurance, county building operations costs, and mandated local matches for public assistance programs, which the county is mandated to pay.

The estimated increase in taxes per family for Measure L is between $70-$300.

There is no way to get accurate data on how often residents of Madera County shop in Fresno, and how much they spend there, effectively financing Fresno County fire departments with our sales tax. People have to be honest with themselves about just how much of their disposable income is spent in another county. The amount will be different for each person.

How often do you shop at Costco, Walmart, Target, Trader Joe’s, Kohl’s, Sears, Home Depot, Best Buy and other stores in Fresno? How often do you go out to dinner and to the movies in Fresno, and where do you buy appliances, clothing, electronics, sporting goods, building materials, furniture, household goods, office supplies and eye glasses? Geographic realities and the fact that many Madera County residents work in Fresno means that much of our potential sales tax revenue is collected by our neighbor to the south, and is not available to fund the Madera County Fire and Sheriff’s Departments. Residents are going to pay sales tax either way, but everyone must ask: where do you really spend your money? No one can answer that question for you.

The County asserts that visitors to Yosemite, Bass Lake and other areas of the county will pay a large percentage of the tax. With a sales tax, property owners will not be singled out – everyone participates equally, including tourists, who often avail themselves of the services of our emergency responders when they have accidents, suffer medical episodes, start fires or need to be rescued.

The County spends 29.9% (or $77.6 million) on Welfare. Let’s use that for fire and sheriff.

The County has control over just 4 percent of welfare spending. The remaining 96 percent is mandated by the State and Federal governments and can’t be used for anything else.

We’re already paying $150 for a fire protection fee. What happened to all that money?

The “Rural Fire Fee,” as it has come to be known, is collected by the State, not the County, and goes into the State’s general fund. None of that money goes into the County budget. The designated use for that tax is “fire prevention,” and revenue is not used to purchase fire engines, staff or build stations, or hire and train firefighters. Some of the money is currently being used for hazard tree removal in our area, but the Board of Supervisors has no control over that money.

Between December 8, 2015 and January 16, 2016 the BOS voted to spend $4.6 million to increase the salaries and benefits for Madera County workers.

The County cut staffing levels from about 1,334 employees in 2007, to about 1,000 in 2013. The reduction in filled positions and cutbacks in employee compensation saved the County over $12 million dollars, and employees who remained were assigned greater workloads to take up the slack. The net reduction in the number of employees from the beginning of the fiscal crisis in 2007 to the end of the recession was about 300 people.

In the years between 2007 and 2015, County employees received yearly increases, but they were also subjected to furloughs from January 2010 to June 2013, effectively reducing their monthly income by 9.23 percent with some exceptions, depending on their job classification. When they were given raises, the cost was about $4.6 million, leaving a net savings to the County of nearly $8 million. However, approximately 50 percent of that $4.6 million was covered by State and Federal dollars, cutting the cost to the County in half.

The County Budget Office studied salaries in 11 comparable counties, and the current compensation structure is a median with those other counties.

In 2016 after public outcry, a 25 percent increase ($97K annually) in the BOS salary was stopped.

The Board of Supervisors did not receive a raise for seven years. For five of those years, it was due to the financial crisis and the halting of raises for Superior Court judges, to which Supervisor’s salaries are linked. When judges began receiving raises once again in 2013, the Board of Supervisors voted not to accept the raises made available to them, and did so again in 2014. Even while other County employees were receiving salary increases, the Board went seven years without one, putting them far behind not only department heads in Madera County, but also in comparison to neighboring counties.

The money from this tax won’t be spent on police and fire, the County will just spend it any way they want.

The Ordinance specifically prohibits Measure L revenue from being used for anything other than the Sheriff’s Office and the Fire Department.

“Proceeds generated by the sales tax will be dedicated to sheriff and fire services, with approximately 80% of the funds allocated to the Fire Department and approximately 20% of the funds allocated to the Sheriff’s Office. The Public Safety Sales Tax Measure is a special use tax with the requirement that proceeds of the tax are spent only for the specific purposes identified in the Measure’s Expenditure Plan and any future amendments of the Plan.” (http://votemadera.com/wp-content/uploads/2015/07/Full-Color-version-CVIG.pdf)

There will be a Citizen’s Oversight Committee and annual independent audits to ensure that revenues are spent as required, and that information will be made public, as required by the Ordinance.

Cal Fire will just take the money and use it however they want.

Cal Fire and Madera County Fire are not the same; they are two separate entities. Cal Fire is the State fire agency (California Department of Forestry and Fire Protection). Cal Fire firefighters are state employees. The Madera County Fire Department is a separate agency that is funded by the County of Madera, and operated under a contract with Cal Fire. It is staffed by Paid Call Firefighters (PCFs or volunteers), and a few Cal Fire personnel who man five stations under the contract – four in the Valley, and one in Oakhurst.

Each of those five stations has only one firefighter on duty at any given time. The remaining ten stations are not manned at all, and PCFs respond when available from their homes or jobs to gear up, man their engines, and respond to emergencies. Station 8 in Coarsegold is manned and funded through an MOU with the Chukchansi Casino.

Measure L dollars must be spent as outlined in the Expenditure Plan contained in the Ordinance. Cal Fire has no control over the money.

Why should the cities of Madera and Chowchilla get to benefit from our tax?

No money from Measure L will be collected in, or distributed to either the city of Madera or Chowchilla. This tax is for the benefit of the unincorporated areas of Madera County. The city of Madera voted overwhelmingly Yes for a public safety measure in November 2016, but it was not a dedicated tax, and only required a 50 percent +1 margin. The revenue goes into their general fund where it can be used for anything they decide. Measure L dollars, however, will go into a separate fund, and can only be used for sheriff and fire, therefore it requires a 2/3 vote to pass.

You don’t know that this will lower ISO ratings and produce lower homeowners insurance rates.

It’s true that lower rates can’t be guaranteed, but it can be guaranteed that they will stay high or go even higher if nothing is done. The County does expect rates and ratings to go down as the Fire Department is built up.

The BOS is spending nearly $200K for a consultant to inform residents about this 1% sales tax increase.

The County initially conducted research to determine what percentage of the electorate would even consider voting for such a sales tax. If the number was less than two-thirds, they would not have proceeded with the measure, and would not have spent the bulk of the $200K.

In order for voters to make an informed decision, they need to have access to information and learn about the measure. As is standard operating procedure for any government entity planning to put something like this before the voters, the County needed to hire a firm to compile data, design and conduct surveys, hold stakeholder and community meetings, set up websites, and design and print educational information.

The County did not have in-house expertise that could be devoted to the length and depth of this project. Also, having an outside consultant provided a process of objective analysis, review of the data, and specific recommendations before a decision was made.

VRPA Technologies, Inc., was tasked with determining the feasibility: various revenue projections models by a respected government accounting firm using various tax rates and duration of the tax, and polling data. Polling outcome was key in making a determination to proceed. Both functions were subcontractors of VRPA, a firm with previous experience in this process.

The BOS recently approved another $311K for a 956-acre OHV Park off Highway 41 west of O’Neals, which local residents oppose. Now the BOS is discussing the possibility of leasing this property for $8/month for 6 months, then 10K a month for the next year, and then $25K a month for on-going years if this is approved.

The County was tentatively awarded a grant to cover the cost of purchasing a property for a proposed Off-Highway Vehicle park. Local matching dollars of $311,000 were required in order to accept the grant. Those funds have not been released.

According to Chief Administrative Officer Eric Fleming, the County is “in a holding pattern because due diligence is underway, including consultation with tribe. This is not a done deal; if our due diligence shows that this doesn’t pencil out, and doesn’t look like it could pay for itself out of fees collected by an operator, the Board will likely not want to accept the grant.”

In January, the Board voted to extend the due diligence period for six months, during which time the lease on the property is $8/month. That cost was actually paid personally by one of the Supervisors. The $311,000 matching funds are to come from impact fees from the new large developments now being built, says Fleming. “The County collects fees to expand different types of County facilities, including regional parks.”

As for the objection that there is no business plan in place for the project, Fleming says, “You can’t develop a business plan until all the studies are done, addressing environmental concerns on the property. Once that is completed, there may not be enough area for the trails, so at this point, we don’t know what we will be able do on the land.” Fleming says the Board does not intend to spend any general fund dollars, and is not going to be in the business of running an OHV park.

District 5 Supervisor Tom Wheeler says an OHV park is the thing people ask him about most – they want a place to ride their ATVs. He sees it as an opportunity to provide great outdoor family recreation for local residents, and also bring people into the county where they will spend money, thereby contributing even more to the tax revenue.

Currently the BOS is planning on spending more than $550K to purchase land for a Madera County Monument sign off HWY41, and other $500K+ to erect a monument.

CAO Fleming says the Board has not used any general fund dollars for the monument sign project, being considered for east side of Highway 41 near Valley Children’s Blvd.

“We’re looking to find creative ways to work with private developments to finance the project, and I think we’ve come up with a way to do that. Nothing is finalized. The monument has been designed using a portion of one-time monies from an insurance settlement of $180,000. If we can’t find ways to fund through agreements with private development, we won’t recommend taking money from the general fund.”

Why wasn’t this on the November ballot? It costs more to hold a special election.

In the early part of 2016, there were some preliminary discussions between the City of Madera and the County on possibly pursuing a joint effort for a tax measure with a proportional revenue split. After a few meetings it became apparent that the needs of the City and County were different. The City’s expenditure plan could be developed in a shorter time because they could quickly assess their problems and needs based on a single, well defined community.

The City wanted to choose the general tax route — 50 percent plus 1, with no restrictions and a longer tax period — and met their revenue needs with a 0.5 percent sales tax because of the greater amount of taxable retail sales. The County chose a special, dedicated tax — with the higher approval requirement of a two-thirds majority, restricted spending and oversight, and a shorter duration — in an effort to demonstrate to the public the Board’s interest in transparency, and accountability to its citizenry.

The Expenditure Plan for the Fire Department was especially complex, with the varied needs of diverse communities, staffing structures, the blend between career firefighters and PCF staff, and addressing PCF needs. Specifically, the plan had to reflect staffing engines with two firefighters; adding stations to the communities based on call volume, response times and the effectiveness of PCF response; and providing training and medical aid compensation for PCFs for recruitment and retention.

The complexities of the Expenditure Plan and the time required for public response, education and input did not allow the measure to be ready for the November ballot.

The Voter Information Guide is 70 pages long. They can’t expect me to read all this.

The Measure itself is just 11 pages — The Ordinance is six pages (excluding signature page), and the Expenditure Plan is just over five pages long. The text is broken up into easy-to-read sections with appropriately sized font.

There are also seven pages in which the plan is laid out, year-by-year, showing how much revenue is anticipated, and exactly where it will be spent. There are two pages of in-favor arguments, two pages of rebuttal, and a one-page analysis by the County Counsel. The Guide may look daunting, but it’s actually succinct and user-friendly.

The County doesn’t need to raise taxes, they just need to stop the frivolous spending, and they would be able to fund the fire and sheriff’s departments.

District 5 Supervisor Tom Wheeler says the current Board has brought the County from millions of dollars in the red, to operating within their means. He also advises that they have been over the budget line by line, and there is no way to adequately fund the Madera County Fire Department.

“I invite anyone to look at the budget and come up with a better answer,” says Wheeler. “People complain, but they don’t come up with solutions. County government is a lot leaner than it was ten years ago, and if you don’t believe me, look at the budget, and then tell me – specifically – what you would do.”

To look at the Madera County budget, click here.

For more details and the Expenditure Plan for Measure L, click here.

The responses are so selective in the facts and deflect from the concerns it’s like a politician wrote it. Why not give a complete question and answer? Because It wouldn’t support your stance that’s why. Bias propaganda.

We gave the County the opportunity to respond to assertions that they say disagree with their actual budget numbers, and the process happening with the Board of Supervisors on several issues. We also included concerns raised by citizens at public meetings and on social media. We ran a piece from the opposition committee last week, and this is the County’s response to those issues. If those opposed to the measure would like to submit a guest column with facts that disagree with the County’s figures, we will be happy to run it.

Is signage on Hwy. 41 more important than fire service? Sounds the supervisors have about $ 1,050,000 tied up in the idea. If you are going up Hwy. 41 at that point where else are you going? Why do you need a sign?

The County does not have over $1 million committed to a sign. That is simply not true. The land was being marketed at $500,000, but the County has no intention of paying that. They are working with developers and the River Parkway people to work out a deal. A sign has been designed, and the design work was paid for out of a one-time settlement. No money has yet, or is intended to come out of the general fund for the sign.