MADERA COUNTY — On March 7, citizens of the unincorporated areas of Madera County will vote on whether to implement a one-cent sales tax to fund the Fire Department and the Sheriff’s Office.

To ensure that voters can make an informed decision about the proposed Public Safety Sales Tax known as Measure L, VRPA Technologies, Inc., has been contracted by the County to develop an expenditure plan, educate the public about what the tax will be used for, and why they say it is needed.

The Supervisors often address the issue in their regular meetings that past Boards have “kicked the can down the road,” and that service levels at the Madera County Fire Department and Sheriff’s Office are the same as they were in the 1920s. Measure L, they say, is just one piece of a broader puzzle aimed at bolstering the ranks of firefighters and deputies, and putting long-range funding in place.

The following information is from Madera County’s most recent Education Packet, compiled by VRPA:

For many years, the County Administration Office (CAO), elected officials, and involved staff have been analyzing the gap in public safety funding and looking for creative solutions to make viable improvements. They quickly realized that the amount of funding needed to put a dent in the ever-growing public safety need could not be sustainably supported through the County’s budget.

To address the issue, they researched other local-government models and learned that the creation of Fire Districts and the revenue earned via passage of sales taxes, is what supplemented other agencies’ gaps in adequate funding. Following discussion, it was decided that a public safety sales tax would be the least intrusive to residents of the unincorporated area of Madera County for the following reasons:

- A large number of tourists come through the area supporting the public safety sales tax at grocery stores, gift shops, auto repair facilities, restaurants, gas stations, hotels, and other retail establishments; especially in Eastern Madera County.

- Many unincorporated area residents travel to Fresno County or the City of Madera for their day-to-day needs and pay sales taxes in those jurisdictions.

- The State reduced sales taxes by .25 cents as of Jan. 1, 2017, making the 1 percent increase proposed by Measure L less of a burden to local taxpayers.

In addition to the proposed Sales Tax increase, the County felt the need to obligate additional funding to public safety on an annual basis, which has resulted in the resolution to purchase one new fire apparatus each year while continuing to support increased wages for the Paid Call Firefighters (PCFs) who make up the Madera County Fire Department. Funds for the PCFs are in addition to Measure L funding.

The County lists these reasons as to why the tax is needed:

- The Board of Supervisors has local control over just $63 million of the $266 million 2016/2017 budget. The remaining $203 million is controlled by the State and Federal governments. That spending is mandated and can’t be used at the discretion of the Board.

- 64 percent of the locally controlled funds ($40 million) is for Protection Services — Fire Services = 12 percent and Sheriff Services = 28 percent. Increased funding for fire or sheriff services from the general fund would directly impact funding of other important public programs or services.

- Current sheriff staffing levels do not allow for daily staffing of all patrol beats, limiting preventative patrolling, proactive activity, and follow-up.

- Low staffing levels lead to increased response times in emergencies.

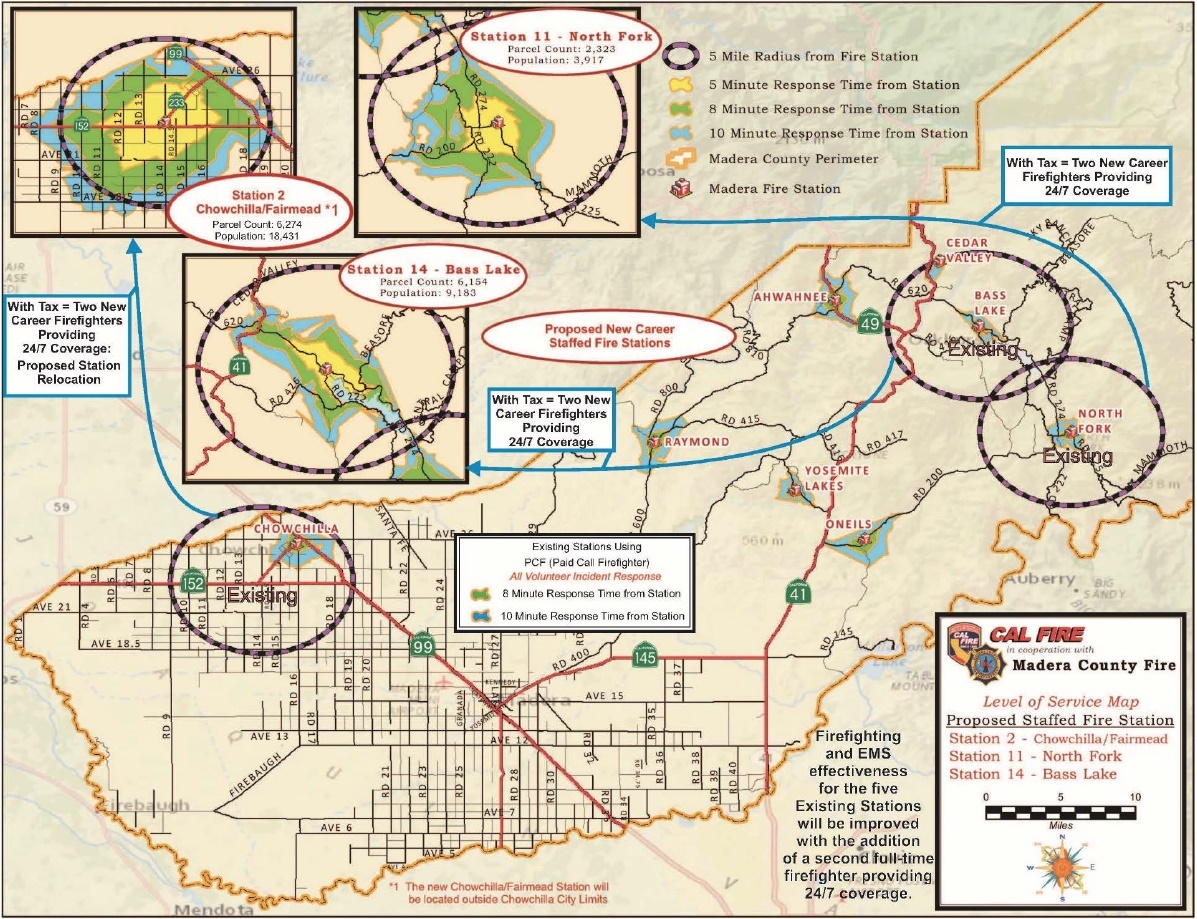

- There are foothill and valley communities with no fire stations.

- There is currently ineffective fire response with a single firefighter on duty at many stations.

- There is limited seasonal staffing of rural fire stations.

- Madera County has a shortage of Paid Call Firefighters (PCFs), whose numbers have dwindled down from 300 to 70 over the past decades.

- The Fire Service also serves as Emergency Medical Service (EMS) first responders. Currently PCF’s are not paid for medical calls, which account for 70 percent of the calls to which they respond. Those calls are made truly as volunteers.

- The increasing tree mortality rates increases the fire risk, and the need for additional staffing.

- Increased homeowner’s insurance is due to Insurance Service Office’s (ISO) Public Protection Classification ratings; ratings are based on a community’s fire suppression system including staffing and response time

In addressing the concerns about recent raises for County employees, these facts are noted in the County’s Education Packet:

- Currently the County has 300 fewer employees than it did pre-recession (2007).

- The remaining County employees have assumed the work load of the former employees.

- County employees did not receive a cost of living rate increase between 2011 and 2014.

- The County has not replaced the 300 employee positions, resulting in a $12 million annual savings in employee salaries and benefits.

- The $12 million in annual savings has more than “off-set” the costs associated with recent cost of living increases for remaining employees which cost the County $4 million annually.

The County has laid out exactly where the funds generated by Measure L would be spent over the 20-year life of the tax:

For complete details of Measure L and the expenditure plan, please visit http://madera-county.com/Proposed-Public-Safety-Sales-Tax.htm

For complete details of Measure L and the expenditure plan, please visit http://madera-county.com/Proposed-Public-Safety-Sales-Tax.htm